HubSpot Payments

Overview of HubSpot payments system

Set up the payments tool

With the payments tool, you can collect one-time and recurring payments from customers in your CRM using quotes or payment links. Payment links can be shared directly with your customers via email or chat, added directly to your website pages, or used with forms.

You can manage your customer's buying experience by providing quick refunds, payment notifications, and receipts. After collecting payments, manage subscriptions created for recurring payments, review your transaction history, download payment and payout reports, trigger workflows, and create custom reports without leaving HubSpot.

Learn more in the payments tool FAQ.

Payments tool setup requirements

Please note the following before setting up the payments tool:

- To set up the payments tool, you must be a super admin.

- Currently, payments is only available to businesses or organizations located in the US that have a US bank account and are using a paid version of HubSpot.

- Payments is designed for customers selling non-physical goods (ex: software, services, events, courses, content, donations, etc.) and is less suitable for those shipping physical goods, as HubSpot does not calculate taxes or shipping fees at this time.

- The payments tool is not supported in sandbox accounts, and should only be set up in standard production accounts. Trying to set up payments in a sandbox account will result in your payments application being rejected. In addition, payment links created in sandbox accounts will appear in the production account instead and cannot be used for collecting payments.

Set up payments

To activate the payments tool in your account, you will need to complete an application process in HubSpot. HubSpot's risk assessment and underwriting team will review your application within two to three business days. Once your application is approved, you can start collecting payments from your customers.

Before starting the application, make sure you have your company's tax identification information, ownership information, and US bank account information ready.

- In your HubSpot account, navigate to Sales > Payments.

- Click Set up payments.

- In the Before you start, is your company located in the United States? section, select Yes. If your company is not located in the US, let HubSpot know where you want to use payments.

- Review the Terms & Conditions and select the checkboxes to confirm you meet the other eligibility requirements.

- Click Next.

- Click Start.

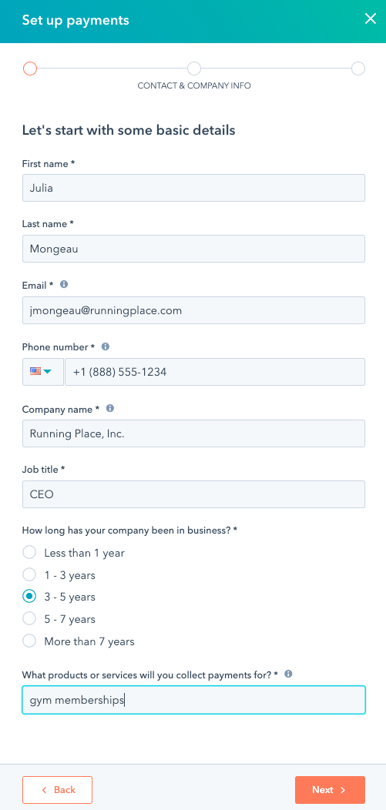

- Enter the owner's first name, last name, email address, and phone number.

- In the How long has your company been in business? section, select a time range.

- Enter information about the products and services you plan to sell using the payments tool so HubSpot can best support you.

- Click Next.

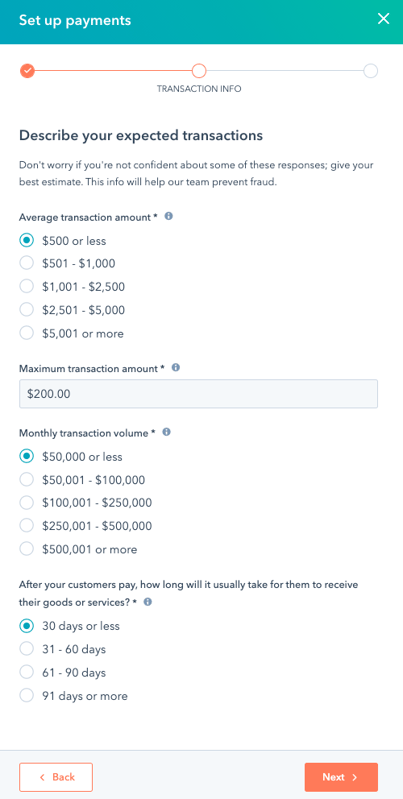

- In the Average transaction amount section, select the average amount you expect a customer to pay per transaction.

- In the Monthly transaction volume section, select the estimated range of cumulative payments you expect to collect during one month via the payments tool.

- In the After your customers pay, how long will it usually take for them to receive their goods or services? section, select a time range option. For subscriptions, use the time from the initial payment to the first delivery.

- Click Next.

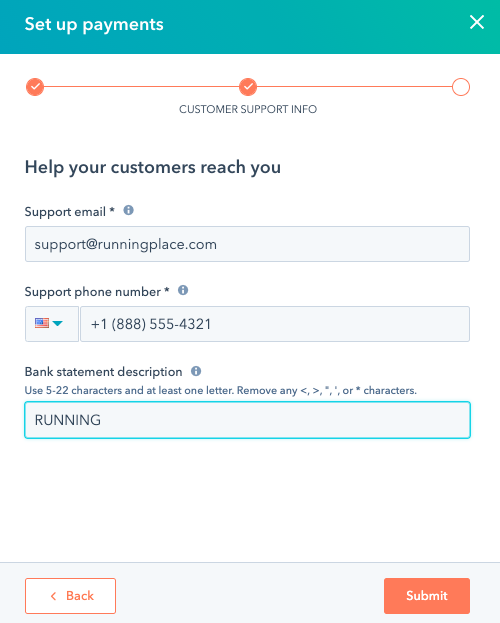

- Enter an email address and phone number for your support team.

- In the Bank statement description field, enter the name that will appear next to the charge on a customer's bank statement. Make sure to use a name that they'll recognize to prevent chargebacks.

- Click Submit.

Add and edit bank account information

After your account has been verified and activated, enter the details of the US bank account where your daily cumulative payments, or payouts, will be deposited. You can add one bank account per HubSpot account. You can also review your current payment processing rates and fees. Only users with super admin permissions can make changes to the bank account information. HubSpot will send an email confirmation to each super admin in the account whenever the bank account information is updated.

If you need to update the name of your company or the authorized representative for your account, contact paymentsunderwriting@hubspot.com. To make other changes to your payments account settings, or to close your payments account, contact HubSpot Support.

To add a bank account, or update the existing one:

- In your HubSpot account, click the settings settings icon in the main navigation bar.

- In the left sidebar menu, navigate to Payments.

- On the Payouts tab, click Add or Edit next to the bank account information section.

- In the right panel, enter the following information:

- Account holder name: the owner of the bank account, which can be a person or a company.

- Routing number: the number that identifies the bank or financial institution in a monetary transaction.

- Account number: the number used to identify the account at a bank or brokerage

- Confirm account number: when first entering new bank account information, confirm the number that you entered in the previous field to make sure it is accurate.

- Click Save.

Once your account has been activated and your bank information has been updated, you can start to create and share payments links, or integrate payments with your quotes.

Set the default payment method and shipping information

When creating new payment links and quotes, the payment method defaults that you select in your payment settings will automatically apply. These preferences are also used when a customer updates their payment information for subscriptions. Changing the default payment method will not impact any existing payment links or quotes, and you can override these settings on an individual payment link or quote.

- In your HubSpot account, click the settings settings icon in the main navigation bar.

- In the left sidebar menu, navigate to Payments.

- Click the Checkout tab.

- In the Billing information section, select the checkboxes next to your preferred form of payment.

- To require a billing address for credit card purchases, select the Collect billing addresses for credit card purchases checkbox.

- To collect your customer's shipping address during the checkout process, in the Shipping info section, click to toggle the Enable shipping to collect your customer's shipping address during the checkout process switch on. Then click the Countries you ship to dropdown menu and select the checkboxes next to the specific countries.

- Click Save.

Set up policies

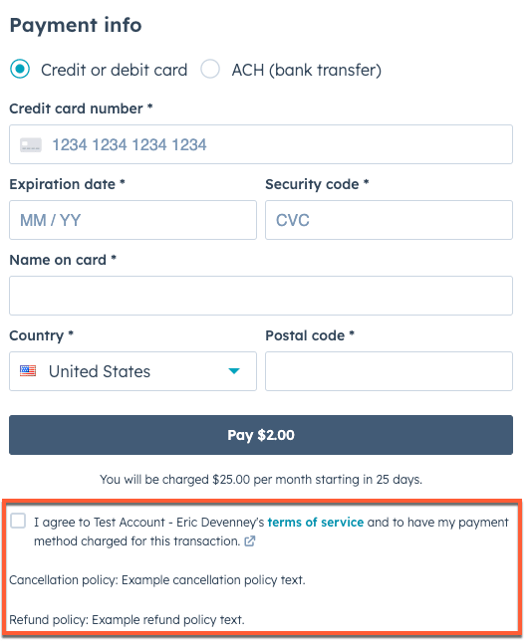

You can configure the buyer checkout page to include a link to your company's terms of service agreement, as well as require the buyer to acknowledge the terms of service before purchasing.

To configure your policies:

- In your HubSpot account, click the settings settings icon in the main navigation bar.

- In the left sidebar menu, navigate to Payments.

- Click the Checkout tab.

- In the Policies section, click to toggle the Terms of service switch on. Once turned on, you'll then be able to configure the terms of service URL and checkbox acknowledgement options.

- In the Link to hosted terms of service field, enter the terms of service URL. Buyers who click the terms of service hyperlink on the checkout page will be taken to this URL.

- In the Cancellation policy field, enter your company's cancellation policy, up to 3,000 characters.

- In the Refund policy field, enter your company refund policy, up to 3,000 characters.

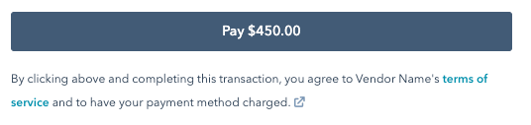

- To require the buyer to select an acknowledgement checkbox before they can purchase, click to select the Checkbox acknowledgement checkbox. When this setting is not enabled, the checkout page will instead display a generic terms of service agreement statement below the checkout button.

- Click Save.

Manage payment notifications

Set up the notifications that you and your customer receive.

Your notifications

By default, you will receive an email notification when you receive a payment or a payout is sent to the bank account listed. Transactions will be automatically deposited to your bank account within two business days for card payments and within three business days for ACH payments. The deposit will appear on your bank statement as HUBSPOT PAYMENTS.

Please note: only users with super admin permissions will receive payment notifications.

If you do not want to receive payment or payout email notifications from HubSpot, turn off these notifications in your settings.

- In your HubSpot account, click the settings settings icon in the main navigation bar.

- In the left sidebar menu, navigate to Notifications.

- Click to expand the Payments notification settings, then clear the Payment received or Payout created checkbox.

- Click Save.

Customer notifications

To manage the notifications that customers receive:

- In your HubSpot account, click the settings settings icon in the main navigation bar.

- In the left sidebar, navigate to Payments.

- Click the Notifications tab.

- In the Customer emails section, configure the emails customers will receive:

- Payment failed: to email customers a link to update their payment method when their payment fails, click to toggle the switch on.

- Upcoming payment reminder: to email customers a reminder 14 days before an upcoming recurring payment, click to toggle the switch on.

- In the Public business section, you can also update your support phone number and email. To make changes to the statement descriptor that appears on customers' bank statements, contact paymentsrisk@hubspot.com.

Set up default payment link settings

After setting up the payments tool, you can also configure the default settings for your payment links. You can override these default settings when creating a new payment link or when editing an existing link.

Frequently Asked Questions

Who is eligible to use the payments tool?

Your business or organization must be located in the US, have a US bank account, and must be using a paid version of HubSpot. In the future, HubSpot may expand eligibility to customers located in additional countries.

You may not be eligible if your company is in a high-risk industry, or sells certain products or services. Payments is powered in part by Stripe, and they don’t accept payments for some types of businesses. You can find more details and examples in Stripe’s restricted businesses list. Keep in mind that this isn’t a complete list, and all businesses are reviewed on an individual basis.

Is payments available in my location?

Payments is only supported in the US for now.

If you're not located in the U.S., HubSpot welcomes your feedback on whether you'd be interested in using payments in other countries. You can let HubSpot know which countries you want to use payments in following the steps below:

- In your HubSpot account, navigate to Sales > Payments.

- Click Set up payments.

- In the Before you start, is your company located in the United States? section, select No.

- Select the checkboxes next to the countries you would want to use payments in, then click Next.

Keep in mind that HubSpot can’t guarantee when, or even if, payments will be made available in any particular country. There are apps available in HubSpot's App Marketplace that you can use with HubSpot to simplify your payment process. Learn more about the available payment apps.

What payment methods are supported?

The payments tool currently supports credit cards, debit cards, and ACH debits (bank transfers). You decide which payment methods to accept from your customers - cards, ACH, or both.

Please note: the payments tool requires at least $0.50 due at checkout. If you're building a payment link with only delayed payment line items, consider packaging them with additional products or requiring a deposit at checkout.

Can I accept payments from buyers outside the US?

Yes, you can accept card payments denominated in US dollars from buyers outside the US. HubSpot support global and regional card brands, including Visa, Mastercard, American Express, Discover, Diners and Japan Card Bureau (JCB).

During the set up process, I was asked to provide personal information as well as information about my business, including ownership information and legal structure. Why does HubSpot require this?

Payment processing is subject to financial laws and regulations that are aimed at preventing money laundering, funding of terrorism and other illegal activities. To satisfy these regulations, HubSpot and other payment service providers are required to verify basic information about the business entity, its primary owners, and the individual who will serve as the authorized representative for the payments account. These obligations are referred to as the “know your customer” (KYC) rules. In addition, HubSpot will also use this information to mitigate fraud that could impact you or HubSpot.

Why does the payments tool require the tax identification number for my business?

The payments tool uses your tax identification number to verify the identity of your business and for reports that HubSpot is required to file with the IRS. The IRS requires HubSpot and other payment service providers to report the total amount of payments you receive on an annual basis. Form 1099-K is the document required by the IRS for this purpose. HubSpot will send you a completed Form 1099-K by January 31 following each calendar year in which payments are processed.

A member of HubSpot’s underwriting team has contacted me to request additional information. What is the purpose of this?

As a payment service provider, HubSpot bears financial risk associated with the processing of your transactions. To protect customers and the businesses and consumers they serve, HubSpot needs to understand the types of products and services that your business sells, your financial situation, and the potential credit risk of your business. This is done through a process called credit underwriting.

In most cases, HubSpot can complete this process automatically in the background within one to two business days of when you first start using the payments tool. Occasionally HubSpot may need to request additional information or speak with you to complete the underwriting process before activating your account.

When the underwriting process is completed, your account will be activated and you can begin accepting payments.

Can I test payments in a sandbox account?

The payments tool is not supported in a sandbox account, but learn how to test your payment links in test mode before sharing them with your buyers.

Security

Is the payments tool secure?

The payments tool uses multiple layers of security to protect sensitive payment information. The payments tool is built using Stripe's API integration to manage the secure collection and transmission of payment data. Your buyer's payment credentials are encrypted and tokenized by Stripe to help ensure that unauthorized parties do not gain access to sensitive payment information.

Is the payments tool compliant with PCI requirements?

Yes, HubSpot payments uses infrastructure provided by Stripe, Inc., a leading provider of digital payments infrastructure. Stripe’s infrastructure is certified to comply with the Payment Card Industry’s Data Security Standards (PCI-DSS) Level 1, the payment industry’s highest level of protection.

Does the payments tool require my business to validate compliance with PCI security standards?

With most traditional payment processors, businesses that accept card payments are required to annually validate their compliance with PCI by submitting documentation and undergoing network vulnerability scans. With the payments tool, Stripe acts as the payments processor, which means that unless you separately process card data, you are not exposed to card data and are therefore not required to validate your compliance with PCI.

Rates & fees

How much does it cost to use payments?

There are no setup fees, monthly fees, minimums, or hidden charges. HubSpot charges a percentage of each transaction, so you only pay for the service when you use it.

- For credit and debit cards, you pay a flat 2.9% of the transaction amount.

- For ACH payments, you pay 0.5% of the transaction amount, which is capped at $10 per transaction.

How will my business be invoiced for payments fees?

Rather than being included on your regular HubSpot invoice, the fees for payments are automatically deducted from each transaction. To see the fee for a particular transaction, navigate to the Transaction history tab and select the transaction. To generate a report showing the total fees for a particular time period, click Download reports and select Payments.

Will I be charged a fee for refunds?

HubSpot does not currently charge a fee for processing a refund. However, you will not receive a refund of the fee associated with the original transaction.

Is there a limit to the number of payments that can be processed per day or per month?

There is no limit to the number of transactions that can take place, though the maximum individual transaction size is $100,000.

There is also a maximum dollar amount per month that applies to each account, which is determined through the underwriting process and communicated to you in your welcome email.

Stripe's role with payments

What is Stripe's role, and can I use my existing Stripe account?

Stripe provides the underlying infrastructure for payments features that are built in HubSpot and is responsible for the secure processing, transmission, and storage of sensitive payment information. HubSpot does not directly capture or store such information, and only surfaces certain tokenized or partial information about transactions within your HubSpot account.

The payments tool is not the same as the HubSpot-Stripe integration, and you can't use an existing account. When you set up payments, you’ll navigate to Stripe to enter a few details about your company and verify your identity. You’re not creating a new login, and you won't need to log in to Stripe after that.

I already use payments in quotes with Stripe. How is this different?

With the Stripe integration, you can integrate a quote with Stripe checkout so customers can pay with a credit card directly from the quote. The payment details will then appear in your Stripe account.

When you set up payments with HubSpot, you don't need to install the Stripe app. Instead, you’ll send customers to a checkout page with your own branding. You can also support more payment options, including ACH and credit card, and offer more flexible terms for recurring payments. After customers pay, you won’t need to log into a separate account and can instead track and manage all of your data in HubSpot.

How do I migrate data from my other Stripe account?

Stripe does not support migrating data from an existing account to HubSpot.

Chargebacks and ACH returns

What is a chargeback?

A chargeback is a reversal of a card-based transaction. It is a forced refund from you, the seller, to your customer, the buyer. Chargebacks occur when a buyer disputes a charge by contacting the bank that issued their credit or debit card. The cardholder’s bank will then take one of the following actions:

- Dismiss the case and inform the cardholder that the charge is valid,

- Send an inquiry to the seller to gather more information about the case, or

- Decide the customer’s claim is legitimate and issue an immediate chargeback.

Cardholders may initiate chargebacks only for certain permitted reasons. Those reasons include:

- Fraud, where the cardholder claims the purchase was made by a fraudster using stolen card information. Learn how to mitigate risk of payment fraud.

- Duplicate or incorrect transaction amount, where the cardholder claims they were charged twice for the same transaction or were charged the wrong amount.

- The goods or services were not received from the seller.

- The goods or services are defective, or are different from the description provided by the seller.

- The cardholder cancelled a recurring transaction but was charged for it anyway.

In most cases, the cardholder must initiate the chargeback no later than 120 days following the original transaction.

How will I be notified of a chargeback and how do I respond?

HubSpot’s payments risk team will notify you via email if you receive a chargeback. HubSpot will assist you with challenging the chargeback if you do not believe the reasons for the chargeback are valid. HubSpot will also handle all communications with the card networks on your behalf and inform you of the outcome.

If you decide to challenge the chargeback, respond to the notice quickly, because most of the card brands only provide a 20-day response window from the chargeback date. After that, the chargeback will be final. If the chargeback is upheld by the card network, HubSpot will recapture the original transaction amount by deducting it from your future payouts or debiting it from your bank account. You do not need to issue a refund for the chargeback amount, as the cardholder's bank will issue the credit for the disputed charge, and the cardholder should contact their bank to check on the status.

Why do I see two reverse transfers for a chargeback?

When a chargeback is initiated by the card issuer on behalf of a buyer, Stripe debits the disputed amount from the HubSpot account. If the dispute is then lost, the disputed amount will be reverse transferred back to the HubSpot account from Stripe. Sometimes the disputed amount will be greater than the original transaction amount due to the currency conversion rate applied at the time that the dispute was initiated. When this occurs, HubSpot will first reverse transfer the original transaction amount from Stripe, then will transfer the remaining amount as a second transaction, resulting in two transfers.

What are some ways I can minimize chargebacks?

- Make sure your customer terms and conditions are very clear on your website, proposals and contracts, especially with respect to refund and cancellation policies.

- Use a statement descriptor that your customers will recognize. Your statement descriptor is the name that will show up on your customers’ credit card or bank statements when they are charged for a transaction. If you’ve branded your business or website with something other than your company’s legal name, HubSpot recommends using your branded, doing business as name on the statement descriptor instead. You can add your statement descriptor by going to your payment account info settings in HubSpot, or reach out to HubSpot support to get it edited.

- Be available to customers for questions by clearly providing your contact information, including email address and phone number, at the time of transaction.

What is an ACH return?

Transactions passing through the Automated Clearing House (ACH) system can fail or be reversed later for a variety of reasons. The most common reasons for upfront failure are:

- Insufficient funds: the buyer does not have enough money in their bank account to cover the transaction.

- Account closed: a previously active bank account has been closed.

- Unknown account: no such account exists.

An ACH transaction that initially succeeds may be reversed later for the following reasons:

- Unauthorized transaction: the buyer claims they did not authorize you to debit their bank account.

- Previous authorization revoked: the buyer who previously authorized you to debit their account has revoked the authorization.

How will I be notified of an ACH return?

HubSpot’s payments risk team will notify you via email. For upfront failures, HubSpot will notify you within five business days of the transaction date.

When an ACH transaction initially succeeds and is reversed later, HubSpot will notify you as soon as the team is aware of the return. ACH rules provide a two business day window for business bank account holders to reverse an unauthorized transaction. However, consumer bank account holders have up to 60 calendar days following the original transaction date.

When responding to an ACH return, you will need to directly contact your buyer to arrange an alternative payment. If this is not successful, your remaining recourse is to take legal action against the buyer. If your buyer has reversed the transaction due to a claim that they did not authorize the transaction, and you believe this is incorrect, providing evidence that the buyer authorized the transaction may be helpful to your case. To retrieve a copy of the buyer’s original authorization, navigate to the Transaction history tab in your payments settings.

Reconciliation

Is there a way to sync payments and payouts with my accounting system?

You can use QuickBooks workflow actions to sync payments collected in HubSpot to your QuickBooks Online account. These payments can be synced as paid sales receipts or paid invoices based on your business requirements.

If you use accounting software other than QuickBooks online, you can export the data from HubSpot then upload it into your accounting system. Navigate to theTransaction history and click Download reports to export transactions from HubSpot. For security purposes, only users with super admin permissions may perform this action.

Transactions

Why was my customer's transactions declined?

Transactions may be declined for reasons such as (but not limited to):

- Incorrect billing information

- Insufficient funds

- Incorrect account number

- Making a payment through a blocked IP address

If your customer's payment is declined, you can ask them to verify their payment method and billing information on the checkout screen before they try again. If they continue to experience issues, you can request that the customer try a different payment method or try again at a later date. If the customer experiences a failed transaction while using a VPN, the customer should consider trying to complete their purchase again off of the VPN or on a different device.

Why haven't I received a payout for a recent transaction?

A common reason for merchant payout failure is incorrect banking information in the payments tool. If someone has successfully made a purchase but you haven't received a payout, ensure that your bank account information is correct. After updating your bank account information, the payout will be attempted again automatically.